7F — it sounds cool, or it sounds foreboding. In Yoakum, Texas it’s a cattle brand used by a family ranch for generations. Here, it’s a recruiting scam that members of this community started chronicling in the comments section of this article. The logo at right belongs to a team of phony recruiters.

7F — it sounds cool, or it sounds foreboding. In Yoakum, Texas it’s a cattle brand used by a family ranch for generations. Here, it’s a recruiting scam that members of this community started chronicling in the comments section of this article. The logo at right belongs to a team of phony recruiters.

7F

7F is just one alias of a company also known as SevenFigureCareers, which we exposed for impersonating a lawyer and for practicing law without authorization when it threatened a user of this website (see SevenFigureCareers: Threats and fraud). My new ranching buddy in Texas — whose ranch is registered as 7F, Inc. with the State of Texas and which has nothing to do with the subject of this story — says his branding iron looks nothing like the 7F logo.

SevenFigureCareers

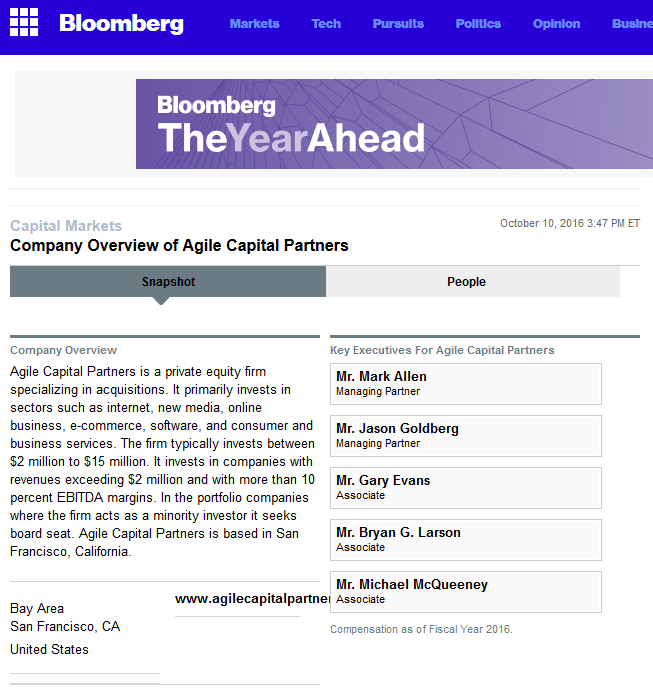

SevenFigureCareers recruiter Arthur French scheduled the phone interview for John Rice with Mark Allen, Managing Partner at Agile Capital Partners, a private equity (PE) and mergers and acquisitions (M&A) firm.

Agile wanted to hire an executive for one of its start-up companies.

Rice, a former executive at a Fortune 50 company and founder of several companies himself, says the job interview started like this:

John Rice: “What firm did you say you were with?”

Mark Allen: “Agile.”

Mark Allen: “Agile.”

JR: “Who?”

MA: “Agile!”

JR: “Spell that.”

MA (irritated): “A-G-L-I-E!”

JR: “What?”

MA (angry): “I told you, A-G-L-I-E!”

“He kept misspelling it,” Rice told me. “Halfway through the interview, it just sounded fraudulent so I said I’d rather terminate this.”

A few minutes later, recruiter Art French called and screamed at Rice that he was out of line with Allen. Rice hung up the phone and called American Express to stop payment on the $2,500 he had paid French to deliver “seven-figure job opportunities.”

Rice didn’t know that the guy who interviewed him — Mark Allen — doesn’t exist.

SevenFigureCareerS

Depending on where you look, SevenFigureCareers’ name varies. It ends with a capital S in a PR Newswire press release: “SevenFigureCareerS.com Candidates Have Been Offered 33 Positions – Still Seeking 40 Executives for Portfolio Company Positions Owned by Private Equity.” The company’s name also surfaces on its contracts as 7FigureS, 7F, 7FIGureS, 7F.7Figcareers — and more permutations than I’ve bothered to count.

Just what is SevenFigureCareers? According to the press release:

With over 14 years of experience providing highly-qualified executive candidates to the private equity and venture capital communities in the United States and internationally, SevenFigureCareerS has established relationships with leading private equity firms including; Agile Capital, Rock Hill Capital, Briarcliff Solutions, A.G. Becker and Argo, LLC. Currently, we have active relationships with over 411 companies which represents over 1,200 total portfolio company opportunities, however SevenFigureCareerS needs to fill 40 of these positions by the end of 2015.

There’s something else Rice and all the other executive victims solicited by Arthur French (a.k.a. Art and Tony) don’t know. The “leading private equity firms” that 7F recruits for don’t exist. Any of them.

Art and Tony French

Art and Tony French

I couldn’t find any evidence online or elsewhere that any of the SevenFigureCareers people exist. French’s sales pitch always emphasizes that his firm, his clients, and the big-name PE firms involved in these recruiting deals require the utmost confidentiality.

When one victim asked French why he’s not on LinkedIn, he explained that he has such a big network that if he created a LinkedIn profile he’d be so inundated with requests to connect that he could never handle them. So he prefers to stay under the radar.

Neither of the French aliases have a LinkedIn profile that remotely suggests they have anything to do with SevenFigureCareers, 7F, or any of the firms they claim to work with. On occasion, report French’s victims, Tony will call and forget he referred to himself as Art the last time they spoke — and explain that he’s got a twin. The “brothers'” voices are indistinguishable — though twins sometimes do sound alike.

Arthur French has a slideshow on LinkedIn’s SlideShare site which conveniently gives him a presence without any searchable information — like his name connected to 7F — on LinkedIn itself:

Arthur French has a slideshow on LinkedIn’s SlideShare site which conveniently gives him a presence without any searchable information — like his name connected to 7F — on LinkedIn itself:

http://www.slideshare.net/SevenFigureCareers/arthur-french-executive-recruiter-and-with-recruiter-64799300

One slide notes the firm has been in operation for 14 years. A few slides later, we learn SevenFigureCareers has been in business 25 years. This site lists 2244 Faraday Avenue in Carlsbad, CA as the firm’s address.

Arthur also maintains a WordPress.com blog: https://sevenfigurecareers.wordpress.com/. French explains how “Your Data & Privacy is Kept Confidential by Arthur French at 2244, Faraday Ave.” It’s also how he re-directs searches for “Arthur French Complaints.” Check his August 17, 2016 posting titled “Arthur French Complaints.” Other post titles prominently include Google search keywords like “reviews” and “complaints” and “complaint.”

French’s sites mainly serve the same purpose his press releases do: They give his victims “credentials” to read.

Here are more credentials:

https://www.yelp.com/biz/seven-figure-careers-carlsbad-2

http://www.scamadviser.com/check-website/sevenfigurecareers.com

The Set-Up

Here’s how the deal is presented to the victim.

Recruiter Tony or Art French solicits you by e-mail after finding your profile on LinkedIn or in the database of a members-only executive networking group.

The Frenches tell you they have assignments to fill executive positions by Agile Capital Partners and RockHillCapitalPartners CB, small private equity firms that participate in big funding deals done by well-known investment partnerships like Apax Partners LLC, a legitimate British private equity and venture capital firm headquartered in London.

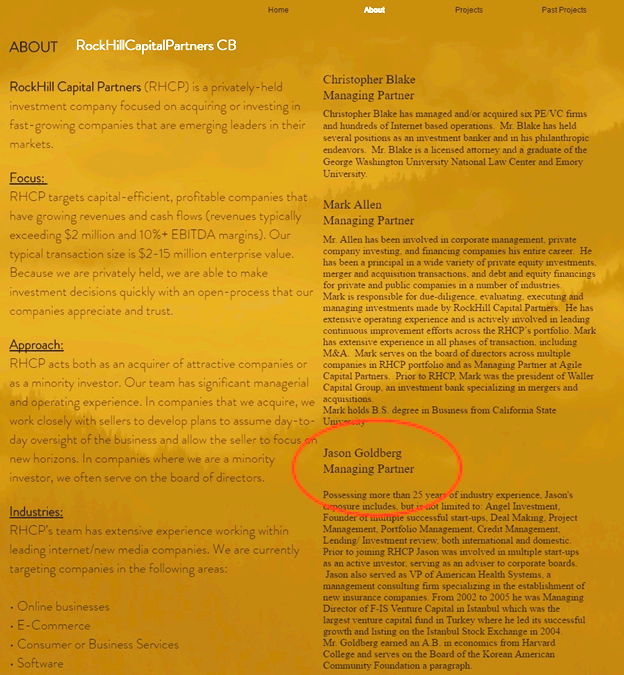

Mark Allen, Jason Goldberg, Christopher Blake and David Marx are managing partners at Agile and RockHill. One of their names appears on an e-mail that French forwards to you. This is the “original e-mail” bait used to convince you the job opportunity is real.

Mark Allen — it’s usually Allen — tells French in the e-mail French shares with you that you’re an excellent candidate and that Apax wants to move quickly to interview and hire you.

From: Mark Allen [mailto:m_allen@rockhillcapitalpartnerscb.com]

Sent: Monday, August 29, 2016 8:42 AM

To: recruiter.afrench@sevenfigcareers.com

Cc: Christopher Blake

Subject: Re: [victim’s name redacted]

Hi Tony, We are going through with the Telecommunication Technology Solutions As A Service Company deal based in the San Jose California area. Expecting the deal to be closed by the 2nd week in September. I really like this candidate for the Chief of Business Management role, and have suggested to the other directors to approve [name redacted], for an interview. Let us know his current employment status/availability. Copying C. Blake, on this email so we can get [name redacted], interviewed quickly. For the time being, have no issue with the compensation you listed or providing an appropriate relocation package if required. Really like this candidate Art, but please keep it confidential.

All the best,

Mark Allen, Managing Director

RHCP

All scammers are sloppy and it’s how they get busted. Note that Allen addresses the e-mail to Tony, but later refers to him as Art. This is just one of many tip-offs that something is wrong.

7F references

When a prospective victim starts asking questions and wants to talk with a reference about 7F, French volunteers a managing partner from Anderson and Vance Capital Advisors — Greg Anderson.

But the reference doesn’t wash: “Sounded like B.S. to me based upon his inflections, tone and lack of ease in the conversation,” said one who got away after talking with Anderson.

Julie: Social engineering

There’s also a bit of artless social engineering in the e-mail described above, intended to make you believe there’s a close business relationship between French and his client Allen. The mail thread includes another e-mail appended to the end — and the exact same material about “Julie” appears in many mails to many victims:

Mark,

Good talking to you and glad to hear Julie is doing better. Here is that candidate I feel will fit nicely with the Telecommunication / Technology Leadership role we discussed. The type of values you usually expect from a seasoned industry expert are what I see here with [victim’s name redacted].

Thank you

A. French

VP Recruiters

7F

866 621 1062

French’s mail is of course intended only for Allen, but now you’re an insider, and you can hope Julie is doing better, too. Now French tries to reel you in.

Strictly confidential — and expensive

French tells you his client, the job, the deal itself, the managing partner, any interviews, anything you hear or learn during the process — all of it — are highly confidential. You must sign a highly restrictive non-disclosure agreement (NDA) and pay $2,500 to get the interview with the managing partner.

One victim reported: “I had a short conversation with Tony and asked for a reference. He is going to have someone call me. He stated the reason there is no info on the Internet is because they are contractually bound not to advertise any of their activities by the PE/VC [venture capital] companies they have contracts with.”

A tip-off

The first clear indication of a scam — even before you sign anything — is the phony, accelerated interview process. A real headhunter (or recruiter) will actually interview you in depth before daring to introduce you to a client.

But the Frenches don’t interview anyone — they just need your signature on a four-week contract that includes a non-disclosure agreement (NDA), and your American Express card, and you’re off to the races.

By signing the NDA you agree that, if you utter a word anywhere about anyone or anything connected to this deal, you will pay a penalty “equal to the base service charge in the agreement multiplied by ten.” In other words, $25,000.

A bigger tip-off

Recruiters and headhunters never charge you money for a job interview or for any other service. They are always paid by the employer — their client.

Another tip-off

Note in the e-mail above, where French forwarded Allen’s e-mail to the victim, French violated confidentiality. Allen clearly wrote to him: “Really like this candidate Art, but please keep it confidential.”

The NDA

Another victim questioned the NDA. French explained why he doesn’t want job seekers doing any due diligence or any research to confirm what’s real and what’s phony about the deals French is selling:

Due to the confidential nature of our client company’s executive job searches and the level of financial compensation for our candidates, we must ask you to refrain from doing any due diligence or research activity on the Internet until we have been given approval by our client company.

You must click to accept that you will not violate the confidential terms and conditions of this search assignment, that you will not participate in any research type due diligence activity on the Internet that is associated in anyway shape or form with the client company or company’s presented to you, before we can share any information about this confidential skill match job opportunity.

Most of our executives have assigned confidential searches during their careers and understand the restrictions that surround a business relationship that has an in place (NDA) Non-Disclosure Agreement.

7F has developed an automated MATCH technology platform, a different approach to executive recruiting which gives us a significant competitive advantage in the marketplace. The smart shared-value approach technique is unique and has been used for 14 years helping 7F develop an exclusive list of client companies and over 1,000+ executive placements.

We deliver high-end, high paying opportunities to our candidates that we seek out personally for each of them.

Sincerely,

Tony French

VP Recruiters

[Note the “automated MATCH technology.” A painfully ironic coincidence — call it poetic justice — will arise later when we learn what happens to French’s business.]

Say what???

I’ve never seen any kind of NDA used by a recruiter that imposes such an onerous penalty. In fact, I’ve never known a recruiter to ask a job candidate to sign an NDA. Much of recruiting is based on reputation, good faith, and good communication. After all, confidentiality is a matter of mutual interest — a candidate doesn’t usually want what she’s doing with a recruiter disclosed, especially not to her current employer.

In John Rice’s case, he asked me to remove comments he’d posted on my blog because he’d signed the NDA and, after being threatened, feared he’d be liable to 7F for $25,000.

One Week Free Trial!

One Week Free Trial!

If French thinks you may balk, he tells you he’s going to discount his regular fee to only $1,500. If he’s not sure he’s set the hook deeply enough, he may offer you a “1-WEEK FREE TRIAL” — but you still must sign the NDA.

Slam-Bam-Thank-You-Ma’am

Now it’s time for Mr. French to deliver.

After you’ve signed everything and paid up, it’s usually Allen that interviews you — always on the phone. If Allen likes you, the “partners” at Apax will hire you for the company they’re funding.

A tip-off

There’s never a face-to-face interview, or personal assessment of any kind. They just tell you you’re going to get a seven-figure job through e-mail and phone calls.

Putting aside the fact that real headhunters and recruiters always interview prospective candidates in depth, victims have described the “interviews” Allen himself — the client/employer — conducts as downright impertinent and vapid. Allen so ticked off John Rice that Rice ended the call — because Allen didn’t know how to spell the name of his own PE firm.

The kiss-off

A few days later, and after several phone calls and e-mails intended to burn up as much of the four-week contract term as possible, French always gives you bad news.

It wasn’t your fault, and the client loved you, but for some unknown reason the funding deal went south. It was the big PE firm’s decision, not Allen’s.

But French is going to present you to lots of other private equity firms for loads of other great jobs — while the contract quickly comes to an end.

If you call French to complain, your call is routed to James Chris — V.P. Account Management. Chris has a very thick accent that’s hard to guess at. Caller-ID identifies Chris’ number in Missoula, MT. He also e-mails from Ops.admin@sevenfigures.com — the same address used by a phony lawyer to threaten John Rice. Chris can’t help you with anything, but he explains that, going forward, all communications with 7F will go through him.

What is SevenFigureCareers or 7F?

After Tony French solicited him, one victim’s due diligence turned up a different kind of problem:

I contacted the business licensing offices for both Carlsbad and San Diego, CA and neither listed 7F as a company licensed to do business in the respective cities. Both offices told me if they are doing legitimate business in CA, they have to be licensed. I had them try every combination of SevenFigureCareers, 7FigCareers, Seven Fig Careers that I ran across doing my due diligence.

While this target was talking with authorities in California, I was talking with authorities in Texas. I was also calling 7F’s office — several times.

Where is SevenFigureCareers?

A call to the phone number listed on the firm’s website, (866) 621-1062, is always answered by a receptionist after a tell-tale call-forwarding click.

The receptionist will tell you the firm is located at 600 West Broadway, San Diego, CA. She cannot tell you which floor the business is on, or what the suite number is. Calls to three leasing companies in this attractive downtown office building — DaVinci Virtual Office Solutions, Real Office Centers, Allied Offices — reveal there is no such company in the building.

The receptionist will tell you the firm is located at 600 West Broadway, San Diego, CA. She cannot tell you which floor the business is on, or what the suite number is. Calls to three leasing companies in this attractive downtown office building — DaVinci Virtual Office Solutions, Real Office Centers, Allied Offices — reveal there is no such company in the building.

When I called and said I was Nick Corcodilos, the receptionist put me on hold then hung up. When I called back, another receptionist answered the phone and asked me if I was calling because I received an e-mail — and wanted to know who I received the e-mail from. But no one whose name I rattled off from the roster of 7F vice presidents was available.

A call to Art French’s cell phone number — shared by a victim from caller-ID — has a San Diego County area code (760) and an Encinitas, CA exchange, and is answered by voicemail.

Is there anybody in there?

One of 7F’s targets reports turning up something different:

I called Irvine Property Management, which owns the building at 600 W. Broadway, San Diego 92101, one of the addresses 7F lists. Nicki, at Irvine, stated 7F does have a public listing in suite 700, which is an executive suite, but does not have a physical presence there.

A SevenFigureCareers slideshow (http://www.powershow.com/view0/83660d-YjkwM/Sevenfigurecareers_com_Reviews_powerpoint_ppt_presentation) reveals another address: 2244 Faraday Avenue, Carlsbad, CA, telephone number (888) 630-3390.

Another slideshow is at http://www.authorstream.com/Presentation/SevenfigureCareer-2889431-sevenfigurecareers-2244-faraday-ave-carlsbad/

Another slideshow is at http://www.authorstream.com/Presentation/SevenfigureCareer-2889431-sevenfigurecareers-2244-faraday-ave-carlsbad/

When a scammer can’t show legitimate Google search results to victims, it creates phony credentials and posts them on websites like PowerShow and AuthorStream to support the scam.

The firm’s URLs include but are not limited to:

http://www.7figuresrecruiting.com/

http://www.7figrecruiting.com/who-is-sevenfigcareers

http://www.7figrecruiting.com/

A tip-off

Note the footer on the second of those two websites: “All rights reserved 2016 7F JobsinPE.” If that’s intended as a copyright notice, it is defective because it lacks the word “copyright” and the “c in a circle.” But it’s yet another name for the firm, yet another URL. These guys have loads of URLs. [UPDATE: After publication of this article, the above-listed websites were taken down.]

How SevenFigures hides

In his solicitation e-mails, Tony French puts your doubts to rest when you wonder about all the names his firm uses.

The firm is registered “under the product name 7F, which owns approximately 120 different domains we use when we get a confidential search assignment from a new PE / VC group.”

120 different domains. French says this allows 7F to find candidates confidentially. If that’s social engineering to help explain away what you find when you investigate this firm online, it’s the lazy kind.

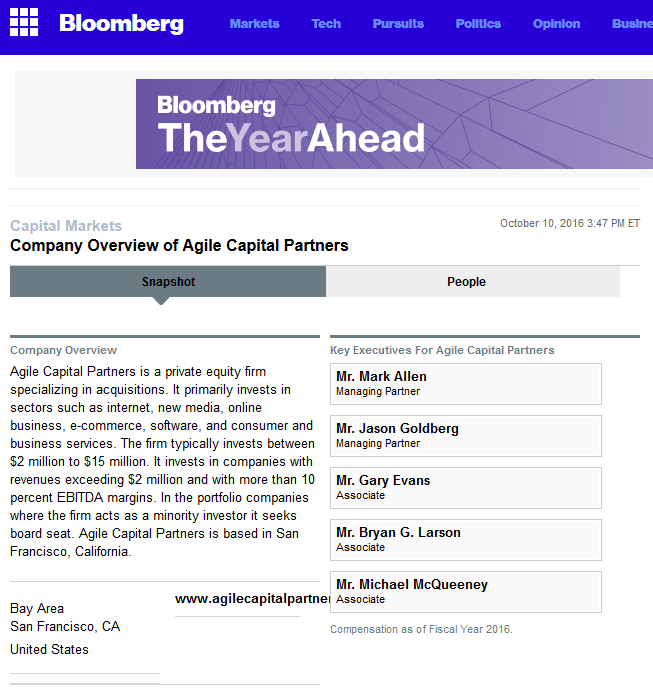

Agile Capital Partners CB

Bloomberg provides a report on Agile, including the names of partners we already know. However, Agile seems to have no address.

Agile claims among its portfolio partners Accelio, Actel, ebay, Creatve TechnologY and Cray Computer. http://www.agilecapitalpartners.com/projects_past.php

Agile claims among its portfolio partners Accelio, Actel, ebay, Creatve TechnologY and Cray Computer. http://www.agilecapitalpartners.com/projects_past.php

According to its newer website, www.agilecapitalpartners.com, Agile has no address or phone number. On its older website (http://www.agilecpg.com/), Agile is located at Terry Francois Street in San Francisco, in Mission Bay. [UPDATE: After publication of this article, the Agile websites went dark.]

There is no street number because there is no Agile Capital Partners CB.

Mark Allen

However, Agile has Managing Partners. One of them is Mark Allen, whose bio states, “Prior to ACP, Mark was the president of Waller Capital Group, an investment bank specializing in mergers and acquisitions.” As of this writing, the only Google result for Waller is:

http://www.manta.com/c/mm8whvc/waller-capital-group-llc

It gives an address at 9578 Pearl Circle, Unit 106, Parker, CO 80134. Here are the Waller offices, courtesy of Zillow http://www.zillow.com/homedetails/9578-Pearl-Cir-UNIT-106-Parker-CO-80134/67454733_zpid/:

A search for “Mark Allen” +”Agile Capital” on LinkedIn yields “Sorry, no results.”

Interestingly, Bloomberg has a bio on Allen that lists him as Managing Partner at Agile Capital Partners in “Bay Area, San Francisco, California.” (http://www.bloomberg.com/research/stocks/private/person.asp?personId=265898347&privcapId=22337494)

There’s no phone number, no address. But we learn that “Mr. Allen is responsible for due-diligence.” So are some of the people he has interviewed who spoke with me about him.

The Agile website says Allen has a partner, Jason Goldberg. Let’s take a look.

Jason Goldberg

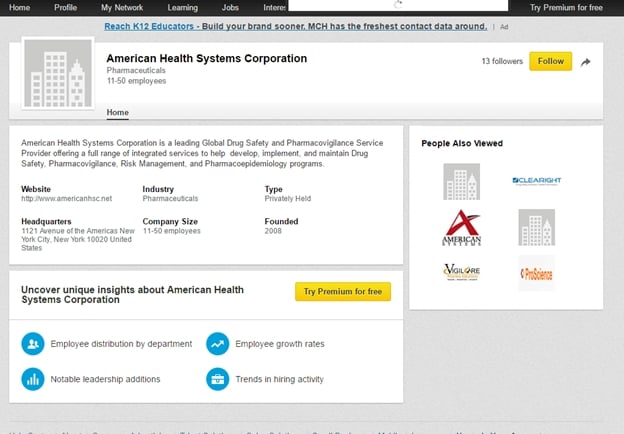

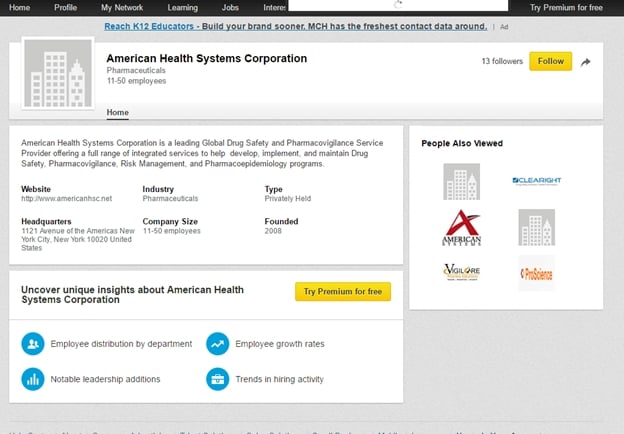

Jason Goldberg’s bio on the Agile website says he “served as VP of American Health Systems, a management consulting firm specializing in the establishment of new insurance companies.”

AHS is on LinkedIn: Its headquarters are at 1121 Avenue of the Americas, New York City. This is the old McGraw-Hill Financial, in Rockefeller Center. The building’s leasing company has never heard of American Health Systems.

But if you click on the company’s website link on LinkedIn, [LINK REMOVED because it now leads to a phishing site] , you’ll visit a link farm. Click the link again. Keep clicking. The target site keeps changing. Would you like to fill out a Comcast survey?

The bio also says Goldberg “serves on the Board of the Korean American Community Foundation.” The foundation’s Deputy Director, Brennan Gang, told me that’s not true. She’s never heard of Goldberg. But she had a good laugh.

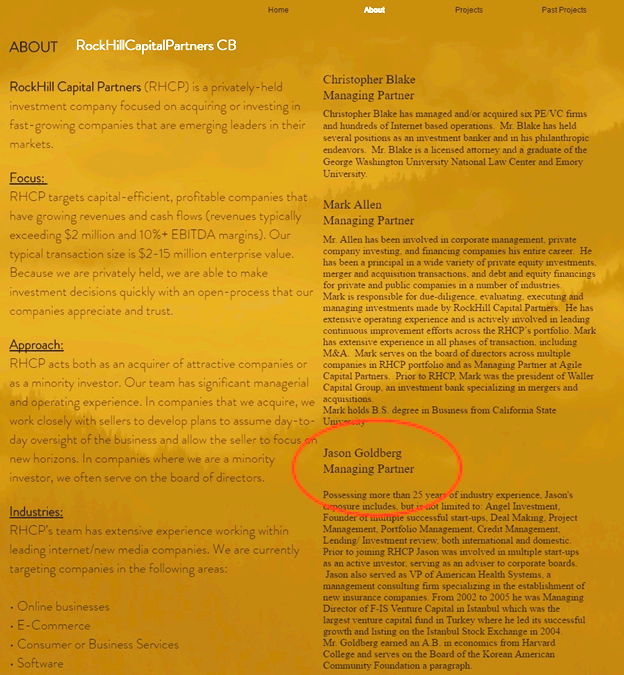

RockHillCapitalPartners CB

Mark Allen is also a Managing Partner at RockHillCapitalPartners CB (RHCP). Check the About page at http://www.rockhillcapitalpartnerscb.com/about.

But don’t confuse this phony firm with the real Rock Hill Capital Partners: http://www.rockhillcap.com/. Executive Administrator Stacey Wells told me there is no Mark Allen at her firm — and she’s never heard of RHCP CB.

Until October 7, 2016 Allen had a partner at RockHill CB: Jason Goldberg. But Goldberg has disappeared. Here he was, a few days earlier:

Goldberg was suddenly replaced by David J. Marx. But no worries — Marx is on the board of the Korean American Community Foundation, too.

In fact, Marx’s bio is the exact same as Jason Goldberg’s:

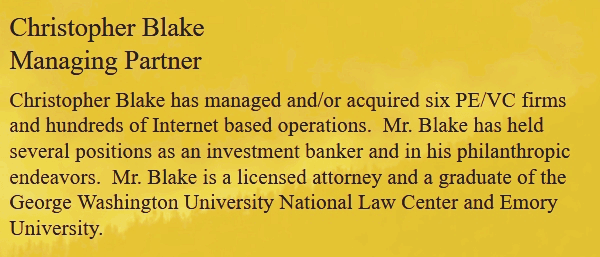

Allen’s second partner at RCHP CB is Christopher Blake. You’ll remember Blake from one of the e-mails above — Mark Allen cc’d him. Blake is a lawyer, but he doesn’t have a Doppelganger:

Nor did he attend Emory University, like his bio states. Could it be another Christopher Blake? No, Emory’s Office of the Registrar told me, “I did not find a record of any Christopher Blake attending Emory.”

There are two sections on the RockHill site that include many company logos — ostensibly clients that RockHill helped fund or manage. I researched several, but the smell was so bad, I climbed out of the wormhole to catch my breath.

Sienna Ventures

Another entity for which 7F fills executive positions is Sienna Ventures. Tony French forwarded to another victim a promising e-mail written by Alan Armstrong, Managing Director at Sienna. Armstrong’s address is listed as a.armstrong@siennaventure.com.

It’s the exact same e-mail written by Mark Allen from RockHillCapital Partners CB about the job candidate described in “The Set-Up” above. It includes the same personal note about Julie at the end. (Note to Tony French: The Internet giveth, and the Internet taketh away after it busteth you.)

Quoting recruiter.afrench@sevenfigcareers.com:

Alan,

Good talking to you and glad to hear Julie is doing better. Here is that candidate I feel will fit nicely with the enterprise software leadership and advisory role we discussed. The type of values you usually expect from a seasoned industry expert are what I see here with [name redacted].

Thank you

Tony French

VP Recruiters

7F

866 621 1062

French is so worried about Julie.

Bloomberg offers this company overview about Sienna Ventures: http://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=22941

And right at the top of the “People” list — there’s Mr. Alan Armstrong, Managing Director. But there’s no Sienna Ventures at 1 Harbor Drive, Sausalito, CA. A call to the number listed on Bloomberg — (415) 475-7530 — yields a pointless set of choices that lead nowhere and the suggestion to visit siennaventures.com.

You’ll find this browser message:

Error 522: Connection timed out

That’s because, like RockHill and Agile, Sienna Ventures doesn’t exist, in spite of what Bloomberg reports. Links for Sienna Ventures found on Google lead to “withdrawn” and “unverified” press releases on WDRB.com and PEHUB.com:

http://www.wdrb.com/story/32400338/sienna-ventures-launches-new-100-million-venture-fund

https://www.pehub.com/2016/07/3342518/

A recent story on Fortune.com, “The Ghost in The VC Machine,” reports that “Sienna Ventures is the latest fake VC firm.” Fortune tries to answer the question, “What’s happening, and who’s behind it?”

Unfortunately, the best Fortune can do is suggest the “Sienna scam” is designed to extract $99 resume-writing fees from suckers who apply for jobs that require resumes in a special format. John Rice should have been so lucky.

Argo LLC, Briarcliff Solutions and AG Becker

Research on these partners of SevenFigureCareers — Argo LLC, Briarcliff Solutions and AG Becker — leads down the same wormhole the others live in. You can do your own research. Here are some links to get you started. Bring breathing apparatus. Call Bloomberg and ask them what’s up with this.

http://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=29764366

http://www.briarcliffsolutionsgroup.com/

https://www.crunchbase.com/organization/briarcliff-solutions-group#/entity

http://agbecker.us/

http://www.bloomberg.com/Research/stocks/private/snapshot.asp?privcapId=2920178

http://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=40423651

The devil is at the end of the story

The 7F wormhole doesn’t end here.

Where does the 7F-SevenFigureCareers wormhole lead? Who and what is at the bottom? Find out in the next installment — where an Ask The Headhunter lawyer will teach us all a thing or two about scams. And where you’ll learn how 7F got its wings clipped thanks to crowd-sourced information shared by the Ask The Headhunter community.

I won’t make you wait til next week. There will be another special edition shortly to report on the rest of the story. And a rancher friend of mine might drop by with a red-hot branding iron. 7F!

Many thanks to all who shared the information, files and documents that greased my path down the wormhole.

For the next part of the SevenFigureCareers scam story, see American Express fires recruiting scam merchant “7F.”

If you’ve had an encounter with SevenFigureCareers, a.k.a. 7F, please drop me a note.

: :

Hey, I don’t knock start-ups. As long as you’ve made your own judgment, and have done it carefully, the decision is yours. So let’s focus on your questions.

Hey, I don’t knock start-ups. As long as you’ve made your own judgment, and have done it carefully, the decision is yours. So let’s focus on your questions.

I’ve been with the same company for five years, with total 18 years’ experience. I’m considering an attractive offer from a year-old start-up financed by a very respected venture capital group. The offer includes stock options. The idea is that someday they’ll go public and will be hugely successful, or someone will buy the company, and we’ll all become rich (on paper).

I’ve been with the same company for five years, with total 18 years’ experience. I’m considering an attractive offer from a year-old start-up financed by a very respected venture capital group. The offer includes stock options. The idea is that someday they’ll go public and will be hugely successful, or someone will buy the company, and we’ll all become rich (on paper). 7F — it sounds cool, or it sounds foreboding. In Yoakum, Texas it’s a cattle brand used by a family ranch for generations. Here, it’s a recruiting scam that members of this community started chronicling in the

7F — it sounds cool, or it sounds foreboding. In Yoakum, Texas it’s a cattle brand used by a family ranch for generations. Here, it’s a recruiting scam that members of this community started chronicling in the  Mark Allen: “Agile.”

Mark Allen: “Agile.” Art and Tony French

Art and Tony French Arthur French has a slideshow on LinkedIn’s SlideShare site which conveniently gives him a presence without any searchable information — like his name connected to 7F — on LinkedIn itself:

Arthur French has a slideshow on LinkedIn’s SlideShare site which conveniently gives him a presence without any searchable information — like his name connected to 7F — on LinkedIn itself: One Week Free Trial!

One Week Free Trial! The receptionist will tell you the firm is located at 600 West Broadway, San Diego, CA. She cannot tell you which floor the business is on, or what the suite number is. Calls to three leasing companies in this attractive downtown office building — DaVinci Virtual Office Solutions, Real Office Centers, Allied Offices — reveal there is no such company in the building.

The receptionist will tell you the firm is located at 600 West Broadway, San Diego, CA. She cannot tell you which floor the business is on, or what the suite number is. Calls to three leasing companies in this attractive downtown office building — DaVinci Virtual Office Solutions, Real Office Centers, Allied Offices — reveal there is no such company in the building. Agile claims among its portfolio partners Accelio, Actel, ebay, Creatve TechnologY and Cray Computer.

Agile claims among its portfolio partners Accelio, Actel, ebay, Creatve TechnologY and Cray Computer.

Who’s really bad in today’s HR Technology world?

Who’s really bad in today’s HR Technology world? “When Joberate technology tells the recruiter that a person’s J-Score went up, it means that person’s job seeking behavior has increased, alerting the recruiter when it becomes the ideal time to contact a potential candidate. At that point a recruiter can send an InMail to a prospective candidate whose job seeking behavior and activities have just increased.”

“When Joberate technology tells the recruiter that a person’s J-Score went up, it means that person’s job seeking behavior has increased, alerting the recruiter when it becomes the ideal time to contact a potential candidate. At that point a recruiter can send an InMail to a prospective candidate whose job seeking behavior and activities have just increased.” I think it’s bulltarkus. Any company that asks you to do an interview by yourself on video might as well hire an inflatable doll. If an employer asks you to invest your time to apply for a job while it avoids investing time in you, think twice before doing it.

I think it’s bulltarkus. Any company that asks you to do an interview by yourself on video might as well hire an inflatable doll. If an employer asks you to invest your time to apply for a job while it avoids investing time in you, think twice before doing it.