In the November 29, 2016 Ask The Headhunter Newsletter, a reader is puzzled about how to answer salary questions in interviews.

Question

Question

What’s the best way to deal with an interviewer who wants to know my salary history and salary requirements? While I know employers always ask this, I feel it takes away from my edge when I divulge that information.

Nick’s Reply

You’re absolutely right — to a point. When you show your salary cards at the wrong time, your negotiating edge disappears. When employers ask for salary requirements, they usually follow up quickly with a question about your salary history. Then they use your last salary to influence any offer they make. And that’s why you need to take control of the discussion.

There’s no puzzle here, if you keep your objectives straight. Your goals should be to:

- Avoid divulging salary history.

- Determine your worth with respect to this job.

- Express your desired salary as a range you can justify, and

- Negotiate a salary that reflects what you can contribute to the company’s bottom line.

Rather than go through the steps, let’s look at the underlying logic. How you apply these ideas is up to you and depends on the situation and on your good judgment.

When salary questions come up, profit is the issue

My advice is to turn any salary questions around and ask what exactly the employer wants you to accomplish for its business. But be even more specific than that.

How to Say It

What kind of profitability goals do you have for this position?

The more the employer expects you to contribute to the company’s profitability, the more you should be paid. Remember that every job contributes to profitability, either by increasing revenue or decreasing costs. If a manager thinks a question about profitability is odd, reconsider whether you want to work for him. This is someone who may not have a job himself in three months.

How to Do It: The PDF book, How Can I Change Careers? — which is for anyone who wants to stand out in a job interview, not just for career changers — provides detailed exercises to help you demonstrate and justify your value. See the section titled “Put A Free Sample in Your Resume.”

Salary history is confidential

In my opinion, discussing salary history is a no-no. It’s no one’s business. Some employers will object, but keeping your past salary confidential is pure common sense because it directly affects your ability to negotiate.

Although an employer may suggest that your old salary is a good indicator of your value, the truth is that it’s up to him to make an independent assessment of your value to his business. Your salary history is personal and confidential, and in some cases your prior employment agreements may even prohibit you from divulging it because it is also confidential to your old employers.

If you still have trouble with this logic, ask yourself, Would an employer divulge the salary history of the job you’re applying for?

How to Do It: Keep Your Salary Under Wraps shows you how to say NO when employers demand your salary history, to make them say YES to higher job offers. Learn how other Ask The Headhunter readers avoid disclosing their salary history politely but firmly. (This PDF book comes with a bonus audio lesson.)

Know what you want

Now let’s talk about your salary requirements. It’s a legitimate question for an employer to ask, as long as it’s couched in a larger discussion about how you will contribute to the bottom line. As we said above, the more value you can contribute to the work, the more you’re worth. There’s no way to provide a desired range until you know what the job entails and what the expectations are — and that requires some discussion. That’s not a cop-out or a clever response to the question. It’s the truth.

But, at some point, it makes perfect sense to decide what salary range you want and to share that information. (Wait until you’re satisfied the employer is one you want to work for, and that this is a job you want.) I think this actually gives you a negotiating edge because it establishes a level of agreement before you get to the offer stage.

When you share your desired range at the proper time, the employer should either agree that he will continue the discussions in good faith based on that range, or you should terminate your discussions. For more about this, see How much money should I ask for?

How to Do It: “The Poolman Strategy: How to ask for more money” is one of the key sections of Fearless Job Hunting, Book 7: Win The Salary Games (long before you negotiate an offer). Many years ago, my own lawyer taught me how to start a negotiation. In this lesson, I teach you how to dominate talk about salary.

Negotiate responsibly

Some people believe you should hide your requirements until an offer has been made. They seem to think that if you divulge what you would accept, the employer will low-ball you. This is nonsense. If you present a well-thought-out range, it gives you room to maneuver based on how well you can articulate your value.

No employer is secretly thinking, “Gee, I was going to offer 50% more than he’s asking for. Lucky me!”

It just doesn’t happen. While some employers are looking for ridiculous bargains, I think you will find that an employer’s target compensation is probably somewhere in the ballpark. (If it’s not, you walk.) When salary questions arise,providing a range and being able to justify it opens the door to a responsible negotiation.

It’s easier to negotiate the right deal when you’ve demonstrated good faith — and firmness — by demonstrating your worth and sharing your goals with the employer.

How to Do It: I know you’ve asked yourself this question — “Am I unwise to accept their first offer?” I cover this in detail in Fearless Job Hunting, Book 9, Be The Master of Job Offers. You’ll also learn a surprising tactic: How to say, “I accept your offer, but I’d like more money!”

Do the salary questions make you nervous in interviews? How do you handle them? What additional tips would you give this reader?

: :

HR came to me and discussed an opportunity that I might be interested in. However, instead of hiring someone else, HR proposed to my boss that he offer me this position while I keep my current position. It’s basically a dual role — two jobs.

HR came to me and discussed an opportunity that I might be interested in. However, instead of hiring someone else, HR proposed to my boss that he offer me this position while I keep my current position. It’s basically a dual role — two jobs. How to Say It

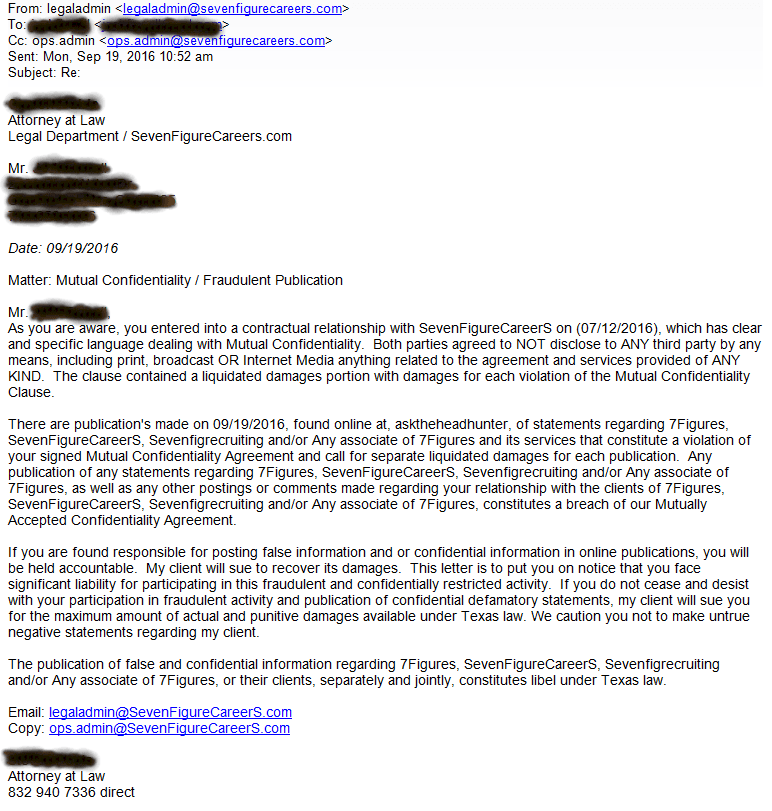

How to Say It SevenFigureCareers

SevenFigureCareers I asked John if he’d called the lawyer. Of course, he said. He left a voicemail because no one answered — but the lawyer never called him back.

I asked John if he’d called the lawyer. Of course, he said. He left a voicemail because no one answered — but the lawyer never called him back. Earlier today the SevenFigureCareers.com website was altered. The 7F logo is gone as is much of the promotional verbiage. Most of the site is now locked down behind passwords. If you type the URL into your browser, the site comes up. But if you click a link to get there, the site yields a blank page with “Nope” in a box at the top. (But if you then put your cursor at the end of the URL in your browser and hit Enter again, the site comes up.) It seems they are trying to avoid inbound links from other sites — like from this article.

Earlier today the SevenFigureCareers.com website was altered. The 7F logo is gone as is much of the promotional verbiage. Most of the site is now locked down behind passwords. If you type the URL into your browser, the site comes up. But if you click a link to get there, the site yields a blank page with “Nope” in a box at the top. (But if you then put your cursor at the end of the URL in your browser and hit Enter again, the site comes up.) It seems they are trying to avoid inbound links from other sites — like from this article. Question

Question Question

Question I passed all of the pre-employment testing in the 95th to 100th percentile. I cleared the background, credit, reference, education and employment verifications and was told I was “cleared” as per the conditions of my signed offer letter.

I passed all of the pre-employment testing in the 95th to 100th percentile. I cleared the background, credit, reference, education and employment verifications and was told I was “cleared” as per the conditions of my signed offer letter. In the end, I win because I still have an amazing job (I am currently employed and not unhappy) and I have the opportunity to secure a position with an organization that will not play games with me after already determining I meet their requirements.

In the end, I win because I still have an amazing job (I am currently employed and not unhappy) and I have the opportunity to secure a position with an organization that will not play games with me after already determining I meet their requirements. I recently had an experience with a headhunter(?) I do not know who sent me an unsolicited pitch to look at a job listing in my field in my city. The pitch was sent via LinkedIn with an attachment. I do not open attachments from people I do not know. This brings up the issue of cyber security in dealing with any kind of pitch about a job.

I recently had an experience with a headhunter(?) I do not know who sent me an unsolicited pitch to look at a job listing in my field in my city. The pitch was sent via LinkedIn with an attachment. I do not open attachments from people I do not know. This brings up the issue of cyber security in dealing with any kind of pitch about a job. Did I say check references?

Did I say check references?

Nick’s Quick Reply

Nick’s Quick Reply