In the April 25, 2017 Ask The Headhunter Newsletter, a reader deals with modern employment: consulting.

Question

I’ve accepted an offer for a job at a company, but technically I’ll be an employee of the Consulting Firm that recruited me and is billing me out. There’s a third company involved, the Screening Company.

Today I received an e-mail from the Screening Company, asking for W-2s from the employer I worked for between 2005-2011. I happen to know that companies verify prior employment electronically, so I asked the Consulting Firm why they needed W-2’s. He said the Screening Company couldn’t confirm my employment. This made no sense to me. I said I would call the Screening Company to work this out, since there was a number on the e-mail for customer service. The recruiter at the Consulting Firm said not to do that, and that I should download the W-2s from the IRS.

I called the Screening Firm anyway, and asked a customer service rep why they needed W-2s to confirm prior employment when I know they can do it electronically. She said the Screening Firm didn’t need W-2s for employment verification, and that it was the Consulting Firm that required W-2s.

But then she said they do call prior employers, in addition to doing electronic verification, and that my former employer did not respond to their request. “Would it be sufficient if my former employer called you?” I asked. She said, “Sure.” So I called the HR department at my former company and asked if they had any outstanding requests to confirm my employment. The answer: No. (Say what??) I asked if they would call the Screening Company on my behalf and they said they would only respond to a faxed request with a copy of my consent, and gave me their Employment Verification fax number.

Fair enough. So I forwarded the fax number to the rep at the Screening Firm and then e-mailed the recruiter at the Consulting Firm to keep him in the loop. I said if they had any other concerns to please contact me.

I already have the offer in hand. I never disclosed my salary history during the hiring process. Why would the Consulting Firm want my W-2s? What exactly is the Screening Company’s role? Why did the Consulting firm claim the Screening firm needed the W-2’s and then tell me not to communicate with the Screening Firm? I have more questions, but can you help me with these?

Nick’s Reply

I don’t see how your prior W-2 (salary) information is anyone’s business. If the Consulting Firm does its job right, it knows you’re qualified to do the job its client needs you to do. Otherwise, what’s it charging its clients for? What does it matter where you worked in 2011 or what you were paid? Just sayin’.

I don’t see how your prior W-2 (salary) information is anyone’s business. If the Consulting Firm does its job right, it knows you’re qualified to do the job its client needs you to do. Otherwise, what’s it charging its clients for? What does it matter where you worked in 2011 or what you were paid? Just sayin’.

You’re asking good questions, but there’s a bigger question: Why are there so many middle-men involved in this?

A cluster of companies

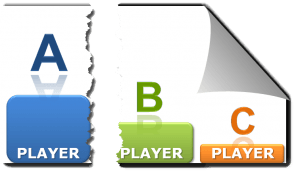

You’ve got:

- The Consulting Firm that recruited you. That is, your actual employer that will sell your work.

- The company where you will actually be working. That is, the Consulting Firm’s client.

- The Screening Company, which processes the hires that its client, the Consulting Firm, makes. The Screening Company seems to be handling the Human Resources tasks for the Consulting Firm.

I’ll hazard a guess that there’s a fourth entity — yet another firm that will process payroll, taxes, and benefits.

There’s a term for the amalgamation of arm’s-length client relationships and consequent finger-pointing that make up this employment game: Cluster-F*ck.

I have no idea how any of these entities can even stay in business with so many hands in the till. You’re not hired to work; you’re rented out to do work. The price being charged for your work far exceeds what you’ll see in your paycheck. Everyone’s getting paid for your work; everyone’s getting a taste of your pay. Good luck figuring it out, because I wouldn’t even start trying to. All I see is a hole in the economy, where money goes without the creation of any value. (See Consulting Firms: Strike back and stir the pot.)

I have no idea how any of these entities can even stay in business with so many hands in the till. You’re not hired to work; you’re rented out to do work. The price being charged for your work far exceeds what you’ll see in your paycheck. Everyone’s getting paid for your work; everyone’s getting a taste of your pay. Good luck figuring it out, because I wouldn’t even start trying to. All I see is a hole in the economy, where money goes without the creation of any value. (See Consulting Firms: Strike back and stir the pot.)

This is not consulting

You’re not being hired by a consulting firm to help it consult to its clients. You’re hired by this Consulting Firm so it can rent you to another company. That’s not consulting. (And don’t confuse what your Consulting Firm is doing with headhunters. See They’re not headhunters.)

Real consulting is an honorable business that creates value. One company turns to another for specialized help: a consulting firm. The consulting firm employs experts in its field that are organized, usually as a team, to solve a client’s problems. Day-to-day work is not the product. A solution, delivered to the client, is the product.

The consultants report to a manager at the consulting firm, not to a manager at the client company. The consulting firm’s employees likely work on multiple client projects at a time. They’re never not working. They’re never “on the beach,” as modern rent-a-worker companies like to call unemployment. (See Will a consulting firm pay me what I’m worth?)

The deal you’ve signed up for is not consulting. None of the companies you describe seem to be responsible for you — or to you. One hires you. You work for another. A third handles the transactions. (I still think yet another will handle HR tasks, like processing payroll and taxes, and administering benefits, if there are any.) When you have a question, each points a finger at the other.

Work for your employer

You’re asking good questions. I don’t have any answers. You’re being forced to deal with middle-men whose roles are questionable. In a well-organized, well-managed business, the functions of all those middle-men are functions of the company itself. A competitive enterprise leverages its expertise with all those functions to produce profit. Beware employers that you don’t actually work for.

My advice is, work for your employer. Avoid any drain of economic value from your work. Don’t let middle-men interfere with the employer-employee relationship. The risk you take when you participate in this kind of cluster-f*ck economy is that you are not the worker. You are the product. You become an interchangeable part. Worse, you become a returnable interchangeable part.

My advice is, work for your employer. Avoid any drain of economic value from your work. Don’t let middle-men interfere with the employer-employee relationship. The risk you take when you participate in this kind of cluster-f*ck economy is that you are not the worker. You are the product. You become an interchangeable part. Worse, you become a returnable interchangeable part.

If the Consulting Firm is paying a Screening Firm to confirm who you are and to handle other transactions with you, so it can charge its client for those services, then what value is the Consulting Firm delivering to its own client?

The employment industry has become one of the biggest rackets going. It really is a clusterf*ck. With workers like you in the middle. But as someone advised a long time ago when a dangerous political entanglement could not be unraveled, “Follow the money.” The real problem here is with the company that’s paying multiple entities so it can rent you. Are you comfortable with this arrangement?

Who do you work for? Who pays you? Are you being paid for the value you create in the economy, or are middle-men draining your value?

: :

After my interview was scheduled I did my due diligence and started doing research to prepare. Sh*t hit the fan when I got to employment reviews on sites like Glassdoor and Indeed.

After my interview was scheduled I did my due diligence and started doing research to prepare. Sh*t hit the fan when I got to employment reviews on sites like Glassdoor and Indeed. What do you think of recruiters demanding the identity of my references — and demanding to check them — often before there’s even any expression of interest from the hiring manager? Some recruiters get seriously butt-hurt when I won’t instantly hand over references, and claim they won’t submit me otherwise.

What do you think of recruiters demanding the identity of my references — and demanding to check them — often before there’s even any expression of interest from the hiring manager? Some recruiters get seriously butt-hurt when I won’t instantly hand over references, and claim they won’t submit me otherwise. We all know age discrimination is not legal. I’m an analytical chemist with a graduate degree and 40 years experience in analytical chemistry. Although I would love to retire and enjoy my grandchildren, I still have the desire (and mental capacity) to work. My issue is simple. I can’t get past the front door. Employers just look at the experience in years and it becomes a matter of “Let’s interview him so we can check off the EEO box.”

We all know age discrimination is not legal. I’m an analytical chemist with a graduate degree and 40 years experience in analytical chemistry. Although I would love to retire and enjoy my grandchildren, I still have the desire (and mental capacity) to work. My issue is simple. I can’t get past the front door. Employers just look at the experience in years and it becomes a matter of “Let’s interview him so we can check off the EEO box.” Recent reports from the Federal Reserve suggest that switching jobs — and probably employers — is the best way to boost your salary and your career.

Recent reports from the Federal Reserve suggest that switching jobs — and probably employers — is the best way to boost your salary and your career. I have your book,

I have your book,  Here are my two rules about salary disclosure:

Here are my two rules about salary disclosure: He was hoping to get a 10% salary bump. After a lot of assessment including talking with his references and having him talk with an industry expert whose opinion I respected, I knew he’d be great for a very different kind of job with my client.

He was hoping to get a 10% salary bump. After a lot of assessment including talking with his references and having him talk with an industry expert whose opinion I respected, I knew he’d be great for a very different kind of job with my client. Would you ever advise quitting a job before having another one lined up? I have completely lost faith my employer and job and I fear getting fired or worsening what’s left of my relationships here. I’d like to quit now. Is that a bad idea? Thanks.

Would you ever advise quitting a job before having another one lined up? I have completely lost faith my employer and job and I fear getting fired or worsening what’s left of my relationships here. I’d like to quit now. Is that a bad idea? Thanks. Unemployment bias and misery

Unemployment bias and misery Question

Question “Hospitals, nursing homes, home care agencies and doctor’s offices, like a lot of employers across the country, have a specific resume in mind. Employers often want new hires to have experience in a specialty such as operating room nursing.”

“Hospitals, nursing homes, home care agencies and doctor’s offices, like a lot of employers across the country, have a specific resume in mind. Employers often want new hires to have experience in a specialty such as operating room nursing.” WANTED: Top Talent Cheap!

WANTED: Top Talent Cheap! My daughter worked an entry level position for a clothing chain in New York, and left to move to California. Her three managers each wanted her to stay, and said they would act as references, because she showed initiative on the job. Since she did what needed to be done instead of just what she was told to do, they wanted to keep her with the company, even if not in their store. She followed the chain’s instructions, and brought a completed application to a store that has openings in California, according to their website. Despite that, they told her they don’t have openings.

My daughter worked an entry level position for a clothing chain in New York, and left to move to California. Her three managers each wanted her to stay, and said they would act as references, because she showed initiative on the job. Since she did what needed to be done instead of just what she was told to do, they wanted to keep her with the company, even if not in their store. She followed the chain’s instructions, and brought a completed application to a store that has openings in California, according to their website. Despite that, they told her they don’t have openings. Nick’s Reply

Nick’s Reply