The February 21, 2012 Ask The Headhunter Newsletter is a special edition about career rip-offs. (You don’t subscribe to the weekly newsletter? It’s free! Subscribe now!. Don’t miss another edition!) As the regulars know, we flow the newsletter into the blog every week — and this is where we churn up ideas and comments to blow topics like this wide open.

CBC TV: Top Tips and Red Flags For Job Hunters

While taping a recent CBC TV Marketplace program titled Recruitment Rip-Off about career rip-offs, host Tom Harrington and I did another segment (7 minutes) that’s our consumer education offering. Tom and I discuss tips and red flags that smart consumers should look for when job hunting — to avoid getting scammed. (When you’re job hunting, not all those requests you get for “interviews” are for jobs you want. They may be interviewing for victims.)

You’ll have far more tips and warnings of your own to share than Tom and I discuss — and I’d like to ask you to post them in the comments section below. Check out the video for some of the basics. (Tom is the bigger guy on the left.)

Career rip-offs are everywhere

They seem to proliferate when jobs are hard to come by, and that’s when job hunters seem to get suckered more easily by rip-off artists who try to sell them jobs — or the promise of jobs.

We’ve covered TheLadders rip-off again and again, and though it costs only around $30/month, the opportunity cost can be huge. (Just ask Mike, the executive who wasted 22 months before he pulled the plug on TheLadders and shared his story.)

Then there are the “executive career management” scams that promise databases of hidden jobs, inside contacts, and exclusive access to employers. They target high-income folks — who seem altogether too willing to spend $5,000, $10,000, $20,000 or more for “expert help” that delivers nothing more than a contract worth less than the paper it’s printed on.

Take it from this Ask The Headhunter reader who lost $12,000 to a “career management firm”:

“PLEASE don’t use my name, because I am horribly embarrassed to admit that I forked over $12 large to a bunch of scum bags in Denver. They’ve changed their name twice since they cashed my check three years ago. I didn’t receive a single — no, not one — interview as a result of their lightening of my retirement fund. They have no secret sauce, they did nothing that I couldn’t have done much better reading Nick’s website and e-books. Damn.” — R.B. [name withheld]

In between are the offers of “free resume critiques.” These rip-offs deliver boiler-plate “reviews” warning that your resume is no good, and then pressure you to buy a $1,200 re-write — even when the resume submitted for a free critique was originally written by the same firm!

What prompted me to do a rip-off edition?

CBC TV: Recruitment Rip-Off

In early February, Canada’s CBC TV flew me to Toronto for a hidden-camera expose of a “job search marketing” racket: Recruitment Rip-Off. CBC’s Marketplace program is the longest-running consumer watchdog show in the world. Its target: A Canadian firm called Toronto Pathways that “recruits” job hunters via their online resumes — but doesn’t hire anyone. Pathways sells $5,000 “job search marketing” services and “absolutely” promises a job. In my opinion, Pathways’ services are absolutely worthless. The same business has operated under five different names in the past seven years. The CEO calls this name game “brand marketing” that “allows a fresh approach.” I call it “hide and seek” played with angry customers.

Whether or not you’ve ever gotten suckered like this, you’ll gag when you see a salesman promise a job to a prospect (“Absolutely!”) in exchange for thousands of dollars. Then the CEO of the firm denies that they promise jobs to anyone.

But the program is more than a rip-off story. It will save a lot of consumers from the fate suffered by the victims whose experiences are profiled. Don’t miss the entire 22-minute news-magazine segment: Recruitment Rip-Off.

Host Tom Harrington and I spend a lot of time on camera reviewing the hidden camera videos, pointing out the tip-offs that reveal something is very wrong. Key among these tip-offs is a full copy of the contract Pathways foists on its victims. Note the “Client Satisfaction Guarantee” that guarantees no satisfaction or refund. Take notes — How many signs of rip-off can you count?

Rip-Off Resources

I call this the Rip-Off Edition because I’ve been wanting to provide a reference list to help you avoid rip-offs and career scams. Here are some of the best columns on this topic that have appeared on Ask The Headhunter:

SevenFigureCareers: Anatomy of a Recruiting Scam

Resume Trafficking: The job-seeker’s nightmare

Job-Board Journalism: Selling out the American job hunter

The “Executive Marketing” Racket: How I dropped ten grand down a hole

Bernard Haldane: Busting The Bad Boys

An insider’s revelations about “Executive Career Counselors, Inc.”

Deceptive Recruiting: HR’s last stand? and Deception Rebuked

CareerBuilder Is For Dopes

Liars at TheLadders

How Much Would You Pay For A Job?

TheLadders: How the scam works

Readers’ Forum: Your favorite scams

Free resume critiques: The new career-industry racket

The Dogs of Recruiting

How can I find out whether a job board is the real deal? (video)

An educated consumer is the rip-off artist’s worst enemy

I love it when Ask The Headhunter sends a reader to bed with $7,000 in his pocket:

“I just wanted to write and let you know that your Web site saved me from making a grave error. I went to a career marketing company (Global Career Management in Colorado Springs) last week [October 2006], and they wanted $7,000 up front to get me ‘in front of decision makers.’ When I dug a little deeper, I came across your site and decided to use some of the advice to find out if they were for real. I simply asked for references in two telephone voicemail messages and one email message. I followed up 48 hours later to find out why they didn’t get back to me, and the pitchman responded with a ‘we have decided not to move forward at this time’ email. Of course, they figured out I was on to their scam and decided to cut and run to the next ‘client.’ A half hour on your site was worth more than $7,000 in my pocket.” — Jim Myers

If just one tip-off in the above collection saves anyone money or heartache, then I’m happy. Just remember: No one can promise to deliver a job except an employer, and anyone who makes such a promise while demanding money up front is probably trying to rip you off.

Thanks to CBC TV Marketplace

Many thanks to all at CBC TV’s Marketplace for a jam-packed Saturday in the studio, and for the chance to work on this project: host Tom Harrington, producers Virginia Smart and Marlene McArdle, and the entire Marketplace crew. This program should be required viewing for all job hunters. Which leaves me wondering: The exact same recruitment rip-offs are happening across the United States. But which TV networks are deploying their hidden cameras to warn consumers on this side of Lake Ontario?

Stay tuned. Meanwhile, score one for the Canadians.

(Special thanks to Rodney’s By Bay for the fine Toronto hospitality and the best plate of oysters I’ve ever downed. UPDATE July 2014: For those looking for oysters, Rodney’s is now John & Sons Oyster House, still at 56 Temperance Street, Toronto. I haven’t tried the new place myself, but I’m looking forward to it!)

Have you encountered a career rip-off? Maybe you worked for such a firm and have an insider’s story to tell. Most important, please help us assemble the Intenet’s best list of tip-offs to career rip-offs.

: :

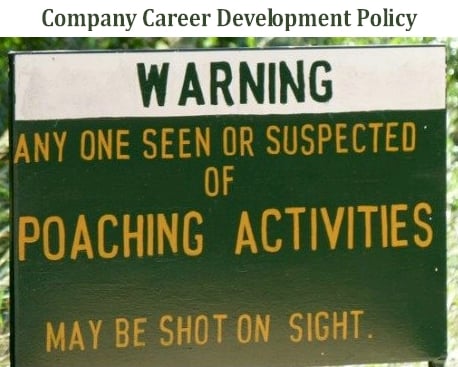

Bosses sometimes make commitments, then conveniently forget about them. What matters is the frequency and the intent of their forgetfulness. It seems your boss forgets a lot, and it’s clear you don’t like the intent.

Bosses sometimes make commitments, then conveniently forget about them. What matters is the frequency and the intent of their forgetfulness. It seems your boss forgets a lot, and it’s clear you don’t like the intent.