Discount Code: MERRYATH

Discount Code: MERRYATH

Time is running out for this year’s biggest discount on all

Ask The Headhunter PDF books!

Visit the Ask The Headhunter Bookstore now! Save 40%!

Pick your books and enter discount code=MERRYATH when checking out. Take 40% off your entire order!

This is a limited-time offer good only until New Year’s Day.

Is your job search stuck?

Finding a job is not about prescribed steps. It’s not about following rules. In fact, job hunting is such an over-defined process that there are thousands of books and articles about how to do it — and the methods are all the same.

What all those authors conveniently ignore is that the steps don’t work. If they did, every resume would get you an interview, which would in turn produce a job offer and a job.

But we all know that doesn’t happen. That’s why I wrote Fearless Job Hunting.

Try Ask The Headhunter for free!

The key to successful job hunting is knowing how to deal with the handful of daunting obstacles that stop other job hunters dead in their tracks.

I didn’t bring you here just to sell you books for 40% off. Of course, I’d love it if you’d buy my books, but Ask The Headhunter regulars know I publish my advice for free. My business model is simple: If you love what you read here for free, you’ll see the value in buying my books. But that’s up to you. My job is to keep delivering tips and advice you can find nowhere else — tips and advice you can use now.

So try Ask The Headhunter for free!

Here are some excerpts from Fearless Job Hunting — and if you decide you’d like to study these methods in more detail, I invite you to take 40% off your purchase price by using discount code=MERRYATH. (This offer is limited — it’s good only until New Year’s Day!)

4 Fearless Job Hunting Tips

You just lost your job and your nerves are frayed. Please — take a moment to put your fears aside. Think about the implications of the choices you make. Consider the obstacles you encounter in your job search.

1. Don’t settle

1. Don’t settle

From Fearless Job Hunting Book 1: Jump-Start Your Job Search, p. 4:

The myth of the last-minute job search

When you’re worried about paying the rent, it seems that almost any job will do. Taking the first offer that comes along could be your biggest mistake. It’s also one of the most common reasons people go job hunting again soon — they settle for a wrong job, rather than select the right one.

Start Early: Research the industry you want to work in. Learn what problems and challenges it faces. Then, identify the best company in that industry. (Why settle for less? Why join a company just because it wants you? Join the one you want.)

Study the company, establish contacts, learn the business, and build expertise. Rather than being just a hunter for any job, learn to be the solution to one company’s problems. That’s what gets you hired, because such dedication and focus makes you stand out.

2. Scope the community

From Fearless Job Hunting Book 3: Get In The Door (way ahead of your competition), p. 6:

It’s the people, Stupid

You could skip the resume submission step completely, but if it makes you feel good, send it in. Then forget about it.

You could skip the resume submission step completely, but if it makes you feel good, send it in. Then forget about it.

More important is that you start to understand the place where you want to work. This means you must start participating in the community and with people who work in the industry you want to be a part of.

Every community has a structure and rules of navigation. Figure this out by circulating. Go to a party. Go to a professional conference or training program. Attend cultural and social events that require milling around with other people (think museums, concerts, churches). It’s natural to ask people you meet for advice and insight about the best companies in your industry. But don’t limit yourself to people in your own line of work.

The glue that holds industries together includes lawyers, accountants, bankers, real estate brokers, printers, caterers and janitors. Use these contacts to identify members of the community you want to join, and start hanging out with them.

3. Avoid a salary cut

From Fearless Job Hunting Book 7: Win The Salary Games (long before you negotiate an offer), p. 9:

How can I avoid a salary cut?

Negotiating doesn’t have to be done across an adversarial table — and it should not be done over the phone. You can sit down and hash through a deal like partners. Sometimes, candor means getting almost personal. Check the How to Say It box for a suggestion:

Negotiating doesn’t have to be done across an adversarial table — and it should not be done over the phone. You can sit down and hash through a deal like partners. Sometimes, candor means getting almost personal. Check the How to Say It box for a suggestion:

How to Say It

“If I take this job, we’re entering into a sort of marriage. Our finances will be intertwined. So, let’s work out a budget — my salary and your profitability — that we’re both going to be happy with for years down the road. If I can’t show you how I will boost the company’s profitability with my work, then you should not hire me. But I also need to know that I can meet my own budget and my living expenses, so that I can focus entirely on my job.”

It might seem overly candid, but there’s not enough candor in the world of business. A salary negotiation should be an honest discussion about what you and the employer can both afford.

4. Know what you’re getting into

From Fearless Job Hunting Book 8: Play Hardball With Employers, p. 23:

Due Diligence: Don’t take a job without it:

I think the failure to research and understand one another is one of the key reasons why companies lay off employees and why workers quit jobs. They have no idea what they’re getting into until it’s too late. Proper due diligence is extensive and detailed. How far you go with it is up to you.

I think the failure to research and understand one another is one of the key reasons why companies lay off employees and why workers quit jobs. They have no idea what they’re getting into until it’s too late. Proper due diligence is extensive and detailed. How far you go with it is up to you.

Research is a funny thing. When it’s part of our job, and we get paid to do it, we do it thoroughly because we don’t want our judgments to appear unsupported by facts and data. When we need to do research for our own protection, we often skip it or we get sloppy. We “trust our instincts” and make career decisions by the seat of our pants.

When a company uses a headhunter to fill a position, it expects [a high level] of due diligence to be performed on candidates the headhunter delivers. If this seems to be a bit much, consider that the fee the company pays a headhunter for all this due diligence can run upwards of $30,000 for a $100,000 position. Can you afford to do less when you’re judging your next employer?

Remember that next to our friends and families, our employers represent the most important relationships we have. Remember that other people who have important relationships with your prospective employer practice due diligence: bankers, realtors, customers, vendors, venture capitalists and stock analysts. Can you afford to ignore it?

* * *

Thanks to all of you for your contributions to this community throughout the year. Have you ever settled for the wrong job, or failed to scope out a work community before accepting a job? Did you get stuck with a salary cut, or with a surprise when you took a job without doing all the necessary investigations? Let’s talk about it! And have a wonderful New Year!

If you purchase a book,

take 40% off by using discount code=MERRYATH when you check out!

Click here to visit the Ask The Headhunter Bookstore!

(This limited offer ends New Year’s Day!)

Question

Question I passed all of the pre-employment testing in the 95th to 100th percentile. I cleared the background, credit, reference, education and employment verifications and was told I was “cleared” as per the conditions of my signed offer letter.

I passed all of the pre-employment testing in the 95th to 100th percentile. I cleared the background, credit, reference, education and employment verifications and was told I was “cleared” as per the conditions of my signed offer letter. In the end, I win because I still have an amazing job (I am currently employed and not unhappy) and I have the opportunity to secure a position with an organization that will not play games with me after already determining I meet their requirements.

In the end, I win because I still have an amazing job (I am currently employed and not unhappy) and I have the opportunity to secure a position with an organization that will not play games with me after already determining I meet their requirements. In

In  Reader 1: Back in the 20th century, employers actually reviewed resumes by reading them rather than scanning them into a computerized ranking system. Keywords have turned hiring into a pass-the-buck game, with HR complaining it can’t find talent! Well, HR isn’t looking for talent. HR isn’t looking for anything. Phony algorithms are keeping the talent unemployed while HR gets paid to do something else! The question is, what is HR doing?

Reader 1: Back in the 20th century, employers actually reviewed resumes by reading them rather than scanning them into a computerized ranking system. Keywords have turned hiring into a pass-the-buck game, with HR complaining it can’t find talent! Well, HR isn’t looking for talent. HR isn’t looking for anything. Phony algorithms are keeping the talent unemployed while HR gets paid to do something else! The question is, what is HR doing? Budget problems may impact hiring and internal promotions, but it’s HR’s job to make sure all the i’s are dotted and the t’s are crossed before HR makes offers that impact people’s lives. Don’t make job offers if you don’t have the authority to follow through. If your company doesn’t give you that authority, then quit your job because you look like an idiot for having a job you’re not allowed to do. What happens to every job applicant is on you. (See

Budget problems may impact hiring and internal promotions, but it’s HR’s job to make sure all the i’s are dotted and the t’s are crossed before HR makes offers that impact people’s lives. Don’t make job offers if you don’t have the authority to follow through. If your company doesn’t give you that authority, then quit your job because you look like an idiot for having a job you’re not allowed to do. What happens to every job applicant is on you. (See  The job of recruiting is about identifying and enticing the right candidates for jobs at your company. It’s not about soliciting everyone who has an e-mail address, and then complaining your applicants are unqualified or unskilled. You can’t fish with a bucket.

The job of recruiting is about identifying and enticing the right candidates for jobs at your company. It’s not about soliciting everyone who has an e-mail address, and then complaining your applicants are unqualified or unskilled. You can’t fish with a bucket. I have a standing challenge to anyone in HR: Give me one good reason why you need to know how much money a job applicant is making. No HR worker has ever been able to explain it rationally.

I have a standing challenge to anyone in HR: Give me one good reason why you need to know how much money a job applicant is making. No HR worker has ever been able to explain it rationally. part of the workforce), there’s plenty of talent out there to fill the 5.6 million vacant jobs in America. (See

part of the workforce), there’s plenty of talent out there to fill the 5.6 million vacant jobs in America. (See  I can understand why companies want and need non-competes and NDAs, but I feel signing such contracts limits my future job opportunities; at least the ones that would pay me the most. So, I could refuse to sign, and they can refuse to hire me. If I want the job, it seems I’ve gotta bite the bullet. Perhaps I could sign the contract as “Darth Vader” and they won’t notice.

I can understand why companies want and need non-competes and NDAs, but I feel signing such contracts limits my future job opportunities; at least the ones that would pay me the most. So, I could refuse to sign, and they can refuse to hire me. If I want the job, it seems I’ve gotta bite the bullet. Perhaps I could sign the contract as “Darth Vader” and they won’t notice. A banker’s story

A banker’s story

With the job market being more favorable to employers, they suggest that getting into the dialog too early can remove you from consideration quickly. While none of us wants to waste time going through the motions only to discover the salary may be too low, it may be more important to stay in the game as long as you can, getting them to like you. It gives you more of an opportunity to sell yourself, too.

With the job market being more favorable to employers, they suggest that getting into the dialog too early can remove you from consideration quickly. While none of us wants to waste time going through the motions only to discover the salary may be too low, it may be more important to stay in the game as long as you can, getting them to like you. It gives you more of an opportunity to sell yourself, too. If you think trying to be likeable and saying “I’m sure you’ll be fair” will help you “stay in the game” longer, you’re going to lose because the employer will take advantage of the fact that you invested all that time — and correctly surmise that you’re going to take whatever they offer you. This is one of the oldest psychological tricks used in negotiating — look up cognitive dissonance. People have a tendency to rationalize and accept lousy job offers because they’ve spent so many hours in interviews.

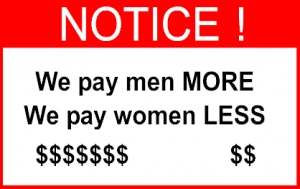

If you think trying to be likeable and saying “I’m sure you’ll be fair” will help you “stay in the game” longer, you’re going to lose because the employer will take advantage of the fact that you invested all that time — and correctly surmise that you’re going to take whatever they offer you. This is one of the oldest psychological tricks used in negotiating — look up cognitive dissonance. People have a tendency to rationalize and accept lousy job offers because they’ve spent so many hours in interviews. The same pundits tell women that they should change their behavior if they want to be paid fairly for doing the same work as men. But the experts, researchers, advocates and apologists are all wrong. There is no prescription for underpaid women to get paid more, because it isn’t women’s behavior that’s the problem.

The same pundits tell women that they should change their behavior if they want to be paid fairly for doing the same work as men. But the experts, researchers, advocates and apologists are all wrong. There is no prescription for underpaid women to get paid more, because it isn’t women’s behavior that’s the problem. Do we need a law?

Do we need a law? Employers who don’t pay fairly will stop getting away with it when they’re required to tattoo their salary statistics on their foreheads — so job applicants can run to their competitors. Or, more likely — since new laws aren’t likely — employers will change their errant behavior when a new generation of women just up and quits. That would be quite a news story.

Employers who don’t pay fairly will stop getting away with it when they’re required to tattoo their salary statistics on their foreheads — so job applicants can run to their competitors. Or, more likely — since new laws aren’t likely — employers will change their errant behavior when a new generation of women just up and quits. That would be quite a news story.