In the January 15, 2019 Ask The Headhunter Newsletter a business owner says a $15 minimum wage law will put him out of business.

Question

I operate three restaurants. It’s getting harder and harder to hire workers. People just don’t want to do this kind of work any more, but for young people it’s actually a good way to learn good work habits. We do a lot to train new employees.

I’ve tried local newspaper ads, online job postings, and I even sent jobs to local college career offices. I know you’ll ask how much we pay and it’s not the $15 an hour they’re trying to raise the minimum wage to. But it’s good pay, $8.75 an hour. I can guess what you’ll say: That’s why the minimum wage should be raised, so people will take these jobs. But I can’t afford it. It would put small businesses like mine out of business. A $15 minimum wage is counter-productive because it will price low-level workers out of jobs altogether.

What else can I do to fill these jobs?

Nick’s Reply

You’re not the only restaurant owner facing a supply and demand problem with labor. And it’s not just the food service industry that’s facing it. Employers across industries have a big supply of jobs but labor is demanding more pay!

I’m not going to mince words. If your business can’t afford to pay a minimum $15 an hour wage, your business cannot afford to exist. You should close it down and let a better-managed competitor hire your employees and service your customers. Many will disagree with me vehemently, but I’ll try to explain why I say this. (See also The Job Monopoly: How companies keep pay low.)

Let’s cut to the chase

My economic logic is simple and you — and many employers — have already discovered it, even if you all pretend otherwise: Nobody’s going to work for you because it costs more to live than the peanuts you’re paying.

You cannot — or you refuse to — pay fair-market compensation. That’s why you can’t hire the workers you need, no matter what your rationalizations are. There is no “talent shortage” in America. That’s politically radioactive bunk!

Fair-market compensation is an amount people need for shelter, food, transportation and other basics of life. That’s more than $70 a day where most people live.

If your business can’t generate enough cash to pay a living wage, your business is going to fail for lack of workers. Shut it down now and get it over with.

A shortage of workers who will work for peanuts

Please read this recent article in Bloomberg Businessweek: Restaurants Are Scrambling for Cheap Labor in 2019. We’re going to discuss your complaints about the “shortage” of workers, which really seems to be a shortage of workers willing to work for peanuts — and the apparent shortage of sound business practices.

Echoing you, the CEO of Applebee’s says to Bloomberg, “It’s hard to find quality folks to work in the restaurants.”

But many restaurants cited in that article “are loath to raise wages, which must be offset by higher menu prices. They count on ample pools of workers willing to accept modest pay.”

Bloomberg also reports a November 2018 Pew Research Center study that tells us there’s a shortage alright — of young workers willing to accept modest pay.

“Just 19 percent of 15- to 17-year-olds had jobs in 2018, compared with almost half in 1968… It wasn’t much better for 18- to 21-year-olds: In 2018, 58 percent had been employed in the previous year, down from 80 percent in 1968.”

That means employers have to take measures to attract their share of a smaller “willing” labor pool.

Misguided hiring strategies

You mentioned what you’re doing to find workers — posting jobs in different places. Let’s look at the “strategies” restaurants in that article have developed “to recruit and retain young workers” in what they complain is a very tight labor market:

- Employers throw “hiring parties with free nacho fries to draw prospects.”

- They hand out “recruiting cards that say, ‘We are looking for great talent like you!’”

- Employers blast out “text messages with links to… food freebies to lure candidates.”

- One employer offers “an employee mobile app” that lets workers swap shifts easily.

- Another tries to keep employees engaged by surveying them about a “new rib recipe” on the menu, and about their “happiness” with their uniforms!

Gimme a break! What do free nachos have to do with convincing people to accept low wages? This is someone’s idea of “strategy” for filling jobs?

From the Bloomberg article: “The younger labor market, they really want to feel connected to a brand,” claims Will Eadie, “global vice president for strategy at WorkJam, which provides training and other digital labor services through a mobile app for clients including restaurants and retailers.”

@*!#&%@#!!

But where’s the money?

While companies pay consultants like Eadie to connect hungry employees to their company brand, a couple of companies in the Bloomberg story are actually giving away money:

- “A Naf Naf Middle Eastern Grill in Madison, Wis., is offering $500 hiring bonuses for shift leaders and assistant managers.”

- “A Wendy’s in New Hampshire last year tried luring candidates with $1,000 bonuses.”

- “Golden Gate Bell [a Taco Bell franchise with 80 locations], which employs about 1,800 and competes with Wendy’s, McDonald’s, and big-box retailers for employees, also recently started a quarterly bonus program for hourly staff.”

Bonuses are a good thing — but a one-time bonus is the oldest compensation trick in the book. It’s a one-time expense a company can write off. But it’s a far cry from permanently higher wages. (See Why employers should make higher job offers.)

$15 wages will put us out of business!

There’s been a national chorus of business owners who oppose a $15 minimum wage. They sing a song about how higher wages would have “an unmistakable side effect: pricing the working poor out of the labor market.”

That’s the tune of an opinion column in New Jersey’s Star Ledger by Matthew Johnson: “I’m a young business owner. Raising the min. wage won’t help N.J.’s working poor.” (Johson “co-owns some family-run small businesses” but does not disclose what they are.)

His claim is the essence of economic hypocrisy in America: “For low-skill workers, the prospect of earning less than $70 for a day’s labor may seem daunting. However, the alternative is a prospect which is far worse.”

Maybe it’s time to go out of business!

In the classic style of a boss who believes he’s earned the right to be greedy because he took the risk of starting a business, Johnson suggests his employees would be worse off if he paid them more — because then he’d have to fire them because he can’t afford it!

I’ve got another take on this. For businesses whose very existence depends on paying less than a living wage, the alternative is that they should go out of business and let more capable, better-managed competitors take their place.

Faced with a $15 minimum wage, warns Johnson, “employers will be forced to make tough choices to remain competitive in our challenging environment.”

There’s no tougher choice in business than accepting failure — or figuring out how to deal with overwhelming market pressures, including the pressure faced by Applebee’s and Taco Bell and White Castle to hire the workers they need to stay in business.

But $8.75 can’t pay the rent. Nor can nacho fries. Those workers want more money! Just like market forces push living costs upwards, market forces will put Johnson and other poorly managed concerns out of business. (See These industries are more likely to screw you on pay.)

Healthy employers and healthy workers thriving together

Johnson needn’t worry about those workers he’d have to lay off. A better-managed competitor like Love2brew Homebrew Supply, also operated in New Jersey, will hire that talent, grow without sacrificing product quality or customer service — and the economy will be stronger as a result.

“We pay all of our employees at least $15 an hour — and it works,” Ron Rivers, founder and CEO of Love2brew, writes in another Star Ledger op-ed: I’m a small business owner, here’s why a $15 minimum wage works for us.

Rivers says the company hasn’t had to raise prices on its 1,500 products to cover higher wages.

“My team entered the home-brew industry with an understanding that a high level of service and customer support would set us apart from our competition.

“We see this as a critical component to meeting and often exceeding our customers’ expectations of excellent service… Raising our starting pay to over $15 an hour has supported our continued acceleration to a position of national leadership in our niche home-brew market… the results speak for themselves as our customers have been coming back for over seven years.”

Like opponents of the $15 minimum wage, advocates of such legislation recite their own saws. Rivers says, “No one earning minimum wage has much, if any, money to put back into the economy — not to eat out, go to the movies, drive down to the Shore for a weekend, or invest in a hobby like home-brewing.“

Paying higher wages is good, he claims. “Historical data help us understand that wage increases lead to more spending and higher overall employment levels.”

Somebody’s right and somebody’s wrong.

The role of government in the economy

There are of course nuances in this debate, and there may be businesses that can argue persuasively that $15 an hour is really a bad idea.

But if we step back historically, like Rivers does, and look at long-term economic and societal trends, it’s pretty clear: Wages keep going up right alongside the cost of doing business, improvements in technology, and the increasing quality of life we enjoy as a result.

When I read op-ed columns by young business owners like Matthew Johnson, I can’t wait for them to grow up. When Johnson proclaims, “It should not be up to government to decide who wins and who loses in this delicate economic equation,” he pretends he lives in a nation where economic equations do not depend on well-thought-out economic policies.

But America is too big to thrive without them. That’s why it’s pure bunk that government should not be involved in setting wages.

The pitchforks are coming

For my money, no one explains the big picture as well as rich guy Nick Hanauer, one of my favorite capitalists. Hanauer is a billionaire with a clear view of how capitalism really works — by plowing profits back into society. I urge you to watch his TED talk: Beware, fellow plutocrats, the pitchforks are coming.

Hanauer is a staunch advocate for a $15 minimum wage, not just because he’s a philanthropist, but because he’s the plutocrat and capitalist so many small business people — like Matthew Johnson — aspire to be. He’s learned something they don’t know.

“Government does create prosperity and growth, by creating conditions that allow both entrepreneurs and their customers to thrive. Balancing the power of capitalists like me and workers isn’t bad for capitalism. It’s essential to it.

“Programs like a reasonable minimum wage, affordable health care, paid sick leave, and the progressive taxation necessary to pay for the important infrastructure necessary for the middle class like education, R&D — these are indispensable tools shrewd capitalists should embrace to drive growth, because no one benefits from it like us.”

Hanauer warns owners of great wealth, owners of businesses big and small, that social upheaval always starts with gross inequities in the distribution of wealth. And today, he says, we’re at a social and economic tipping point. The under-paid workers are restless. The pitchforks are coming.

Who really needs a $15 minimum wage?

I’m not really telling the owner of the three restaurants who submitted this week’s question to go out of business. I expect any dedicated business person to figure out how to run their business profitably — for themselves and for their employees. And I hope they can. But it’s up to them to pull it off — or go out of business.

I think a $15 minimum wage is crucial to America’s economic viability and long overdue. We all need it.

I don’t share Matthew Johnson’s cynical and — yes — greedy interpretation of capitalism. I don’t buy the proposition that some workers don’t deserve a living wage and should be grateful to earn less than $70 a day because to pay them more could put a business owner out of business.

It’s a far more parsimonious interpretation of capitalism that suggests a business which cannot afford to pay a $15 hourly wage should go out of business so that a healthier, better-managed one might take its place.

Our economy is just as dependent on wealthy labor as it is on wealthy management, the two combining to operate profitable businesses that can put more money back into the economy. There is no real growth in a society unless both owners and workers have wealth to re-invest in the growth of the entire nation.

(See Jobs plentiful! Pay is up! But, how are you doing?)

Okay, it’s your turn: Who really needs a $15 minimum wage? Who can live and prosper without it? Can businesses hire the workers they need, if they keep insisting on paying less? Would it really be better if businesses just went out of business if they can’t pay $15 an hour?

ADDENDUM January 15, 2019

Here and elsewhere in the national debate about the $15 per hour minimum wage, apologists for lower pay seem to rely on a silly fallacy. It goes like this:

$8.75 may not be enough in the big city, but in a small town in the Midwest a worker making $8.75 an hour might be able to afford an apartment nicer than city workers making 3 X $15 an hour could even begin to afford.

It’s just not true. Let’s flesh it out. What does $8.75 an hour buy? $8.75 works out to $350 gross income per week, $17,500 per year (assuming a 40-hour week and two weeks of vacation).

Depending on where we look (A, B, C), financial advisers suggest that one’s rent should be in the range of no more than 25% to 30% of their income. That gives the $8.75 wage earner between $364.58 and $437.50 to spend on rent.

Now let’s test the fallacy. Where in the United States can the $8.75 wage earner rent an apartment?

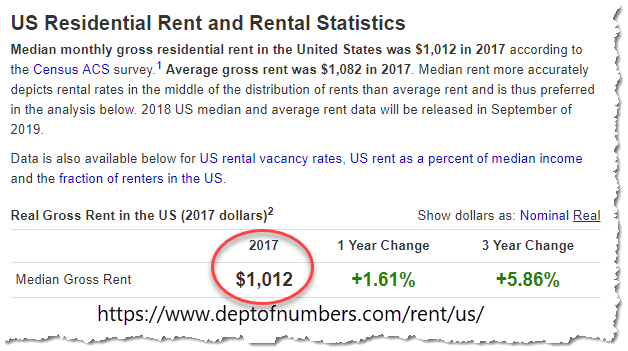

We’ll start with the median rent in America — in 2017 it was $1,012:

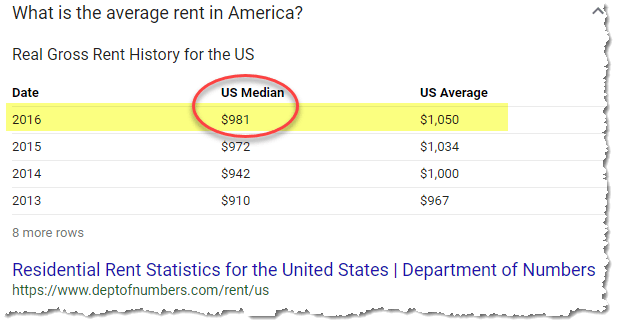

But let’s cut some slack. In 2016 it was $981:

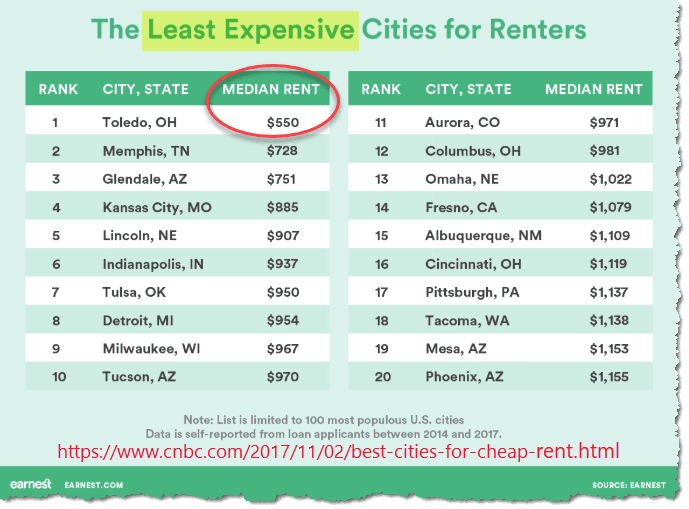

But those are medians. Let’s look at the least expensive cities for renters. In this example, Toledo, Ohio is the lowest at $550:

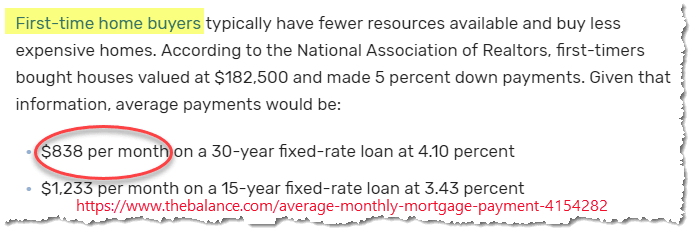

Of course, some people don’t rent. They have a mortgage payment. Maybe they lost their job — they still have to pay the mortgage. Maybe all they can find is that $8.75 wage. While the median mortgage payment in 2017 was $1,022 per month, let’s look at a more conservative figure — for a first-time home buyer who spends less: $838 per month:

It seems that best case our $8.75 wage earner needs to come up $550 per month to live in the lowest-rent city in the country. Now let’s go back to what portion of that earner’s $17,500 per year salary is available to pay rent or a mortgage. Most generously, at 30% of total income, our earner has $437.50 available for rent or a mortgage.

At a $15 wage, that same worker would have $750 for rent. The chart of lowest-rent cities suggests there are three affordable places: Toledo, OH, Memphis, TN, and Glendale, AZ.

So, the fallacy about there being places where a person can get by earning $8.75 or $10 or even $15 is just that — a fallacy.

Don’t agree? Have data that proves me wrong? Please post it!

: :